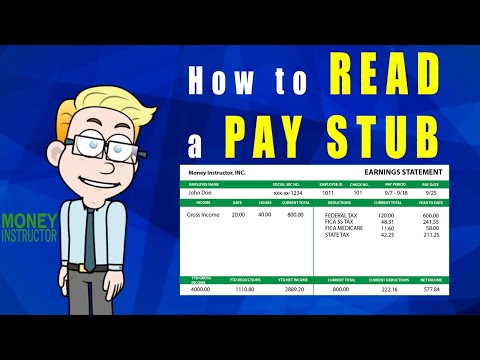

How to read a pay stub as a financial record of their payment employees receive a pay stub although the pay stub may seem confusing it doesn't have to be this brief summary should help you understand it better the pay stub may also be referred to as an earning statement wage statement pay slip or paycheck stub they are all terms that refer to the same thing pay stubs show details about your salary for each pay period although the information on a pay stub can vary it usually includes employee and company information the wages earned for the current pay period as well as the year-to-date a section is often dedicated to tax breakdown which shows how much an employee pays for state and federal taxes a section also shows benefits deductions the most important thing is that the pay stub shows how much you earn if you are employed you may have received a paycheck with a pay stub attached congratulations you got paid if you receive a physical paycheck the pay stub is usually attached to the check if not you may be able to access your pay stub information online if direct deposit is used by your company let's take a closer look at the information you need to know on your pay stub the first thing to note is company and employee information this section includes your company's information also your name employee number and related information next is pay period pay period refers to the time you have worked a bi-weekly pay schedule for example calculates a two-week pay period pay date pay date is the date you receive a paycheck many companies pay their employees on a regular basis such as every other friday this would make friday the expected pay date...

PDF editing your way

Complete or edit your fillable pay stub pdf anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export fillable pay stub directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your pay stub template with calculator pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your pay stub template canada by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Fillable pay stub PDF

- A pay stub template is a useful tool for employees to keep track of their earnings.

- Fillable pay stub PDF forms streamline the process of documenting earnings and deductions.

- Using a fillable pay stub template can help ensure accurate record-keeping.

Award-winning PDF software

How to prepare Fillable pay stub PDF

About Employee Pay Stub

An employee pay stub is a document provided by an employer to an employee, usually alongside their paycheck, that outlines and provides detailed information about their earnings and deductions for a specific pay period. It serves as a record of the employee's compensation and tax information. A pay stub typically includes essential information such as the employee's gross wages or salary before deductions, taxes withheld (federal, state, and local), Social Security contributions, Medicare contributions, any other deductions (health insurance, retirement contributions, loan repayments, etc.), and the net pay, which is the amount the employee receives after all deductions. Employees require pay stubs for various reasons: 1. Income verification: Pay stubs are commonly requested by lenders, landlords, and other financial institutions as proof of income when applying for loans, renting an apartment, or leasing a property. It helps verify the employee's earning capacity and stability. 2. Tax purposes: Pay stubs assist employees in accurately filing their income tax returns. The detailed breakdown of earnings and deductions aids in determining taxable income, eligibility for tax credits and deductions, and serves as proof of tax withholdings. 3. Budgeting and financial planning: By analyzing the pay stub, employees can get an overview of their income and various deductions. It helps in budgeting expenses, setting financial goals, and making informed decisions regarding savings and investments. 4. Employment benefits and entitlements: Pay stubs provide information about deductions for benefits such as health insurance premiums, retirement contributions, and other allowances. Employees can review these deductions, ensuring accuracy and ensuring they receive the benefits they are entitled to. 5. Dispute resolution: In case of any discrepancies or concerns regarding wages, deductions, or withholdings, pay stubs serve as evidence to address and resolve such issues. It allows employees to compare their actual earnings and deductions against what was agreed upon. Overall, pay stubs serve as crucial financial documents for employees, helping them manage their finances, plan for the future, and meet various requirements associated with income, taxes, and employment benefits.

How to complete a Fillable pay stub pdf

- Next, enter the Employee Name, Address, and Social Insurance Number (SIN)

- Fill in the Period Ending and Pay Date

- Under Earnings, input Regular Rate and Hours worked

- Then, enter the Current Year to Date Gross Pay

- Moving on to Deductions, input the Federal Tax and Provincial Tax amounts

- Once all fields are filled out, save or print the completed form for your records

People also ask about Fillable pay stub PDF

What people say about us

Access professional filing opportunities

Video instructions and help with filling out and completing Fillable pay stub PDF