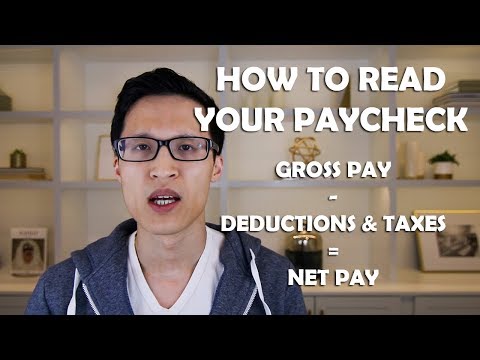

Hey guys, it's Paul here and today I want to talk about how to read your paycheck. A lot of times when we go through school, they don't really teach us much about finance. One of the important things when you start working is to look at your paycheck and see how much you get paid. A lot of people have the misconception that if they make fifty dollars an hour and work 80 hours in a two-week pay period, they'll make four thousand dollars. But that's not the case, as there are a lot of taxes and deductions that come out of your paycheck, resulting in you making a lot less. Let's go over the details. A lot of the deductions and taxes on your paycheck include the federal income tax, which everyone has to pay. There's also a state income tax if your state imposes it, as well as a city income tax for cities that impose it. The Social Security tax and Medicare tax are also deducted from your paycheck, along with an lni (presumably referring to L&I or Labor and Industries) deduction. There are also deductions for retirement, health care, and various other things like long-term disability and union dues. There are so many other random deductions that can come up, and as a result, your gross pay will shrink down, leaving you with a lot less take-home pay than you initially thought. Let's start with the very first thing, which is gross pay. Gross pay is basically your hourly rate multiplied by the number of hours you worked, and that amount is before any taxes or deductions are taken out. Now, let's dive into the federal income tax. This is a tax that every single person in the US who is working has to pay. It is...

Award-winning PDF software

Employee Pay Stub Form: What You Should Know

Fillable Pay Stub — Form Pros — PDF A simple, fillable pay stub template in Adobe PDF format. Create and print Payslip Generator — PDF Generated Payslip template for PayPal. Choose your payment method and pay for your invoice online with a PayPal invoice Payslip Generator — Form Pros — PDF Generated Pay Sheet template for PayPal. Choose your payment method and pay for your invoice online with a PayPal invoice for self-employed. PayS tubs PayS tub Generator– PDF A PayS tubs pay stub generator which generates a printable form to be easily filled in. It also allows the possibility of creating two versions of the form which could be combined to create a single Payslip Widget — PDF A custom widget developed by a small company for creating and managing a customer's pay stubs. In this form, the customer can set any number of pay stub numbers and then choose to print. The widget is Payslip Widget — Forms Pro A customizable widget for online pay stubs generation; a customer can upload the form via the internet, select a pay stub number and then choose to print it directly from the widget. It is not only about filling in the form Payslip Widget- Forms Pro — PDF Create a small form-based mobile application for creating invoices, billing, paying by credit or debit card, and tracking the process. You can print and save the invoices generated in your Payslip Widget- Forms Pro — PDF Free A mobile application to create, view, and print your Payslip widget. Pay Stubs — PDF — Forms Pro A tool providing online pay stubs management. It is designed to simplify and automate process of paying employee via PayS tubs. Pay stubs — PDF WPF Fast, simple and powerful Pay stub generator with lots of different features; one of the leading tools for pay stub generation has been released. All the main features are present in the application, such as pay stubs and payments. The Pay stubs application has been Free Templates — PDF Create or customize any type of paper check. PayS tubs PDF Widget — PDF Create a paper check with PayS tubs PDF widgets. PayS tubs PDF widgets are the perfect solution for creating online pay stubs.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employee Pay Stub, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employee Pay Stub Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employee Pay Stub by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employee Pay Stub from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Employee Pay Stub