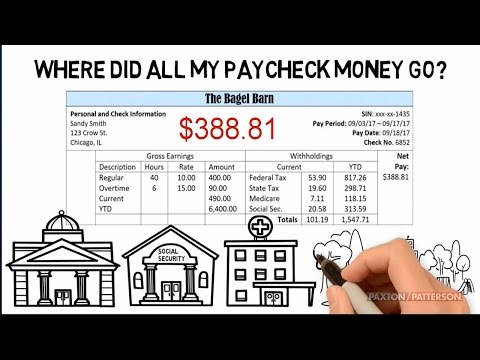

It's the question that's on everyone's mind: if the number two pencil is the most popular, why is it still number two? That is a good question, but it's a little off-topic. - I think a more relevant question is: where did all my paycheck money go? - Well, portions of your paycheck are deducted every pay period. They are listed as withholdings because they are withheld from your paycheck. - Your gross earnings are what you started out with before the deductions, but that amount decreases as the deductions are taken out. - Federal income tax is automatically deducted, and many states also take out income tax. - So, we subtract $53.90 and $19.60. - Then, there are also withholdings for FICA (Federal Insurance Contributions Act). - This tax is taken out to pay older Americans their Social Security retirement benefits and Medicare or hospital insurance benefits. - It's a mandatory payroll deduction, so we subtract $7.11 and $20.58. - Some of these paycheck withholdings will end up benefiting you when you retire, and some ensure that federal, state, and local government functions (roads, parks, police, and schools). - Your net pay is what you're left with after the deductions. - You started out with $490 gross pay but ended up with only three hundred eighty-eight dollars and eighty-one cents net pay. - This means you probably don't have to worry about making minor purchases like a number-two pencil now and then. - But before you go out and buy something really expensive, make sure it's in your budget and that you can pay for it with your net pay.

Award-winning PDF software

Check stub maker with overtime Form: What You Should Know

Last name. Email address. We would really appreciate it if you could share this with your colleagues to raise the profile of the exam. Please use the share buttons to get the best results. You can also share this article with your friends. We are a professional customs broker, not agents. We're not certified, and we will not make promises. I have no interest in doing anything but working for you. If you need something, send me your details, and I'll discuss with you all options, price and other details. Your details are not shared with anyone outside customs' brokerage.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employee Pay Stub, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employee Pay Stub Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employee Pay Stub by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employee Pay Stub from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Check stub maker with overtime